Surcharges and cash discounting are two different pricing strategies that businesses use to adjust their prices and manage their costs.

Credit card surcharges are additional fees or charges added to a transaction, usually to cover the cost of processing payments.

There are regulations (both by card networks and through country/local regulations) around surcharges. Some examples include:

- Surcharge can only be applied to credit cards – debit cards, gift cards and prepaid cards are excluded

- Surcharge should not exceed the merchant cost of acceptance, capped at 3%

- Signage must disclose the surcharge at the point of entry, the point of sale or transaction, and on the receipt.

- Some states do not allow surcharge

Cash discounting is an alternative method of offsetting credit card processing fees and there are no legal restrictions on cash discounting. A cash discount is when a merchant offers a discounted price to a customer if they choose to pay with physical cash for an item or service as opposed to a credit card. This can result in larger numbers of cash transactions and lower fees for merchants.

Implementing cash discounts

Steps for implementing a cash discount program:

- Update pricing: Increase your prices by the effective rate calculated in Step 1.

Let’s say that you pay an average of 2.6% for card purchases, that means you should add 2.6% to your posted prices. Those paying in cash will have that 2.6% percent deducted from their total since the transaction does not incur any processing fees. So, a $10 item becomes $10.26 after you raise the price by 2.6%, and the cash price at the register reverses back to $10. See below on how to use Square’s Export and Import tools on Item Library to make mass changes.

- Update signage and marketing materials: You should update signage and marketing materials to inform customers about the cash discount program.

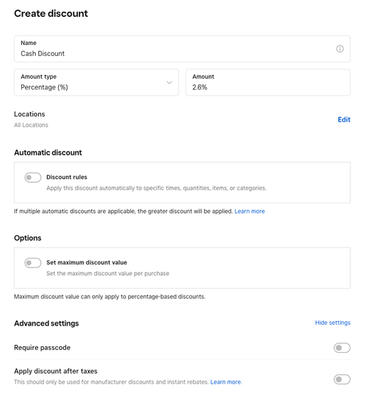

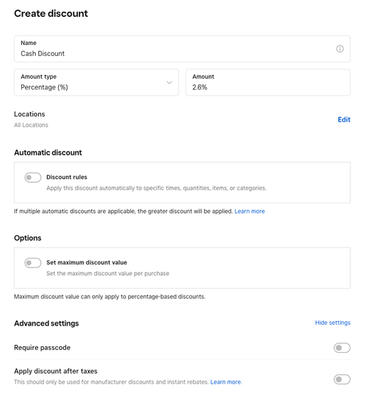

- You will also need to create a discount through Square Dashboard for paying with cash. Name it “cash discount” (or any other relevant name that indicates to the buyer that this discount was applied for cash payments) and enter the percent amount of discount you wish to offer for paying with cash. When a customer is purchasing using cash (and it must be cash, not a credit card or debit card), you will apply the discount you created previously to their purchase. See example below:

- Train staff: It's important to train staff on how the cash discount program works and how to communicate the program to customers. Staff should be prepared to explain the program to customers who may have questions or concerns.

Using Square’s export and import tools on item library

You can use the “Export” feature in Square item library to download your entire item library (in Excel or CSV) and make your price edits in a spreadsheet tool of your choosing (Eg. Excel, Google Sheets, etc.). After updating the prices, you can use the “Import” feature to overwrite the existing prices in Square Item Library with the newly adjusted prices.

Export your library

From within the Square Item Library, select the “Export Library” option from the “Actions” dropdown. You may “Export to Excel” (recommended) which will create a download suitable for most spreadsheets like Excel, Google Sheets, etc.

After you have exported your item library, you can open it in a spreadsheet of your choosing, update the prices, and save the new spreadsheet.

Import updated library

From within the Square Item Library, select the “Import Library” option from the “Actions” dropdown.

Select your updated spreadsheet from the modal. If you wish to replace your existing item library with the upload, toggle on “Replace existing item library” (use caution if you choose this method!)

Confirm that that each Square item attribute is matched to the correct column in your import file:

After confirming, your Square item library will update to match your uploaded spreadsheet:

Potential drawbacks of cash discounting

Cash discounting results in more expensive prices but many of your customers may not realize the price change. And even if they do, it is an easily explainable and viable reason to do so. Customers are also still penalized for paying with cards, potentially negatively impacting customer experience.