- English Community

- Communauté Français

- Comunidad Español

- 日本人 コミュニティ

Learn more about what has changed →

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

[The title of this thread has been edited from the original: Daily report that shows taxable and nontaxable sales in cash and credit]

We are a nonprofit museum, and sell nontaxable admissions as well as taxable gift shop items. I need a daily report that shows that, in cash vs credit. Is that possible? We are new to Square, and this week I had to go through each sale of the day, and manually, on a piece of paper, divide it into cash/credit, taxable/nontaxable, and add up the totals. Some sales include both. HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi @NormaJ !

I do think @JJ_ was on the right track with the Custom Reporting. This will take you a few minutes to set up, but once you have it done it's just the matter of pulling that report.

The first thing to ask: are your nontaxable admissions and taxable gift shop items in separate categories? If not, I highly recommend setting that up first. It'll make setting up the custom report a lot easier.

Now, assuming you have those in place, here's what I would recommend:

- Dashboard -> Reports -> Custom Reports -> Create New

- Clear all reports from the screen. I usually leave the Key Statistics one just for an overall glance.

- Add a Category Sales Report. On this report, choose Filter By, then Item Category and Payment Methods

- On the new dropdowns, choose your nontax category and cash

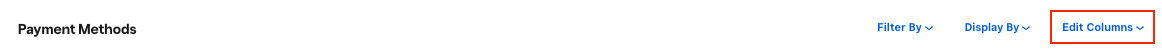

- I'd also recommend adding the Taxes and Returns column under Edit Columns

- Add another Category Sales Report. Do all the same as above just with all the other payment methods besides cash.

- Add a third Category Sales Report. Do all the same but choose the taxed categories and cash

- Add a fourth Category Sales Report for the taxed categories and all the other payment methods besides cash.

Now, once you save this report, it will show those specific category breakdowns automatically.

The only thing to watch out for is if you add a different payment type than what you have listed. The custom report doesn't dynamically update the filters. You'll have to edit the report to add those payment types as you come across them.

Hope this helps, and thanks for the ping @MayaP !

Golden Pine Coffee Roasters

Colorado Springs, CO, USA

Square Champion: I know stuff.

Beta Tester: I break stuff.

he/him/hey you/coffee guy/whatever.

Happy Selling!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hello there @PTmsc

This can be accomplished by creating a Custom Report on your Square Dashboard. You would need to make sure that when adding the "Payment Methods report" you select edit to modify the columns to show the right information you need.

I hope this information is helpful!

P.S. Welcome to the Seller Community

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I tried this, it doesn't offer an option to add non taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @NormaJ- I see this is your first post in the Seller Community, so I'd like to officially welcome you! 🎉👏

We do have a Sales Tax Report that you can filter by source. But outside that we don't have a report like that. I would submit a suggestion to our Ideate Board. In the meantime, I am reaching out to some super sellers who can provide some more suggestions, @TheRealChipA @Candlestore @ryanwanner @Minion @JK_Fiber_Art . Thank you!

Square Community Moderator

Sign in and click Mark as Best Answer if my reply answers your question ✨

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi @NormaJ !

I do think @JJ_ was on the right track with the Custom Reporting. This will take you a few minutes to set up, but once you have it done it's just the matter of pulling that report.

The first thing to ask: are your nontaxable admissions and taxable gift shop items in separate categories? If not, I highly recommend setting that up first. It'll make setting up the custom report a lot easier.

Now, assuming you have those in place, here's what I would recommend:

- Dashboard -> Reports -> Custom Reports -> Create New

- Clear all reports from the screen. I usually leave the Key Statistics one just for an overall glance.

- Add a Category Sales Report. On this report, choose Filter By, then Item Category and Payment Methods

- On the new dropdowns, choose your nontax category and cash

- I'd also recommend adding the Taxes and Returns column under Edit Columns

- Add another Category Sales Report. Do all the same as above just with all the other payment methods besides cash.

- Add a third Category Sales Report. Do all the same but choose the taxed categories and cash

- Add a fourth Category Sales Report for the taxed categories and all the other payment methods besides cash.

Now, once you save this report, it will show those specific category breakdowns automatically.

The only thing to watch out for is if you add a different payment type than what you have listed. The custom report doesn't dynamically update the filters. You'll have to edit the report to add those payment types as you come across them.

Hope this helps, and thanks for the ping @MayaP !

Golden Pine Coffee Roasters

Colorado Springs, CO, USA

Square Champion: I know stuff.

Beta Tester: I break stuff.

he/him/hey you/coffee guy/whatever.

Happy Selling!

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

@NormaJ ;

I use alot of Excel and Google Sheets to find my sales data.

I export the Transactions Detail .csv file.

Square does not have a Non-Taxable column but has a Tax column.

If you Sort the Tax column low to High this would get all your $0.00 taxed items together.

Now another thing you could do is add a category of Non-Taxed. Have this as a Sub category for your Item with the current category as Parent category you already have. Square does let you Sort and Filter by Sub Category on the Square Dashboard but Sub Categories do not show in Excel Exports. This would help you see the Non taxed sales filtered.

Can you give a better understanding of what all you need to see in your report or is it the same as what the original poster was asking ?

Owner

Pocono Candle

Mark as Best Answer if this Helped you solve an issue or give it a thumbs up if you like the answer.

Square Support Number 855-700-6000.

Make Sure App and OS is up to date on your Device.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Square Community

Square Products