- Home

- >

- Help

- >

- Online Store

- >

- Sales taxes out of state

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Sales taxes out of state

In our state of NM, we must charge BOTH sales tax for sales IN state and OUT of state. How do we set this up? This is using Square online.

Different rate for each. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Guess what? I figured it out myself!! YAY!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi there! Can I ask how you figured it out? Im having sort of the same trouble. We plan to advertise to most of the US states, and while we only need to charge state taxes for where we are located, we have to charge sales taxes across all states. And for the life of me I cannot figure out how.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey there @TokinTeds

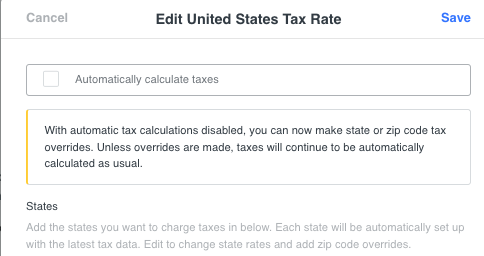

In this case, you will have to set up manual Sales Taxes for all states and charge the correct one for your local state. You can accomplish this by visiting your Square Online Site Overview Page, heading to Settings, and then Sales Taxes. Once there you will want to disable or uncheck "Automatically calculate taxes" this will then give you the ability to select how much you wish to charge your customers from each state.

Here's how that looks:

I hope this information is helpful!

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Square Community

Square Products