- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi there, how are you!

I just got a problem that all my item's price were not including GST. So can I add GST at the end of the invoice that could much easier show my customer what's the price he bought and how much GST he paid.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @ttonefly,

GST is set to be an inclusive tax, rather than an additive tax - so the total price includes the GST rather than adds it on.

Square does have the facility to create inclusive and additive taxes, however I advise you speak to an accountant or financial advisor for further advise on correctly charging GST within your business before making this change! You can edit taxes via the tax section in your online dashboard, then click on a tax and change it from being an inclusive tax to an add on tax (make sure to save your changes!).

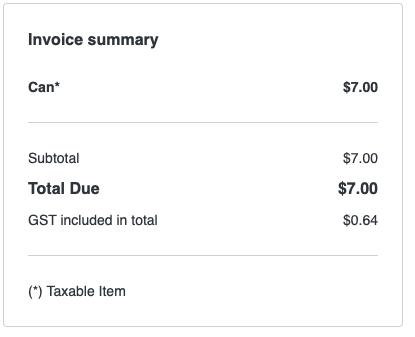

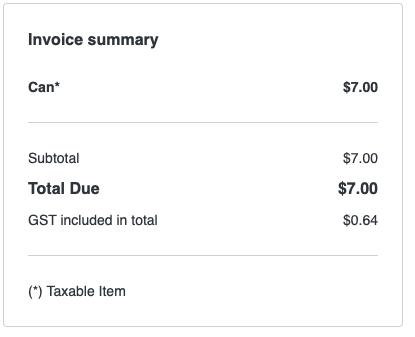

Whether or not the tax is inclusive or added, it should still show the total amount of GST on the receipt/invoice. It should look like this:

Hope this helps, let me know if you're still seeing issues!

Square, Australia

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @ttonefly,

Thanks for reaching out.

Have you made sure that GST is turned on under your tax settings, and have applied it to any items you've create that should have GST turned on?

This option should be no by default provided your ABN is registered for GST. If you're having trouble please feel free to send me a DM and I'll see if I can take a further look, otherwise our support team can be reached on 1800 760 137 (Mon-Fri, 9am-5pm Melbourne time), email via this form or contact us via online chat:

1. Sign in to your Square account

2. Head to our contact page https://squareup.com/help/au/en/contact

3. Go to "Other"" then "I don't see my issue"

4. Click "Message Us"

Square, Australia

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi Seamus, thank you for your reply.

Yes, I had set the GST already for 10%. But whats the problem is the price of my item were not including GST.

So if I create invoice for customer I need to addon GST, not including GST in my item price. Do you understand?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @ttonefly,

GST is set to be an inclusive tax, rather than an additive tax - so the total price includes the GST rather than adds it on.

Square does have the facility to create inclusive and additive taxes, however I advise you speak to an accountant or financial advisor for further advise on correctly charging GST within your business before making this change! You can edit taxes via the tax section in your online dashboard, then click on a tax and change it from being an inclusive tax to an add on tax (make sure to save your changes!).

Whether or not the tax is inclusive or added, it should still show the total amount of GST on the receipt/invoice. It should look like this:

Hope this helps, let me know if you're still seeing issues!

Square, Australia

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thank you so much Seamus, its been solved now. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

No worries @ttonefly!

Square, Australia

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi I'm having the same problem but my invoice is saying no GST added ar the bottom of it but it has been?? So I need help plz

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hi, @Onstop2, thanks for reaching out to let us know.

Can we confirm you have applied your GST tax rule to all relevant items you have added to your invoice? Additionally, we'll get you to check (as per the above steps) that you have set the tax calculation setting to either be included or excluded from your item price.

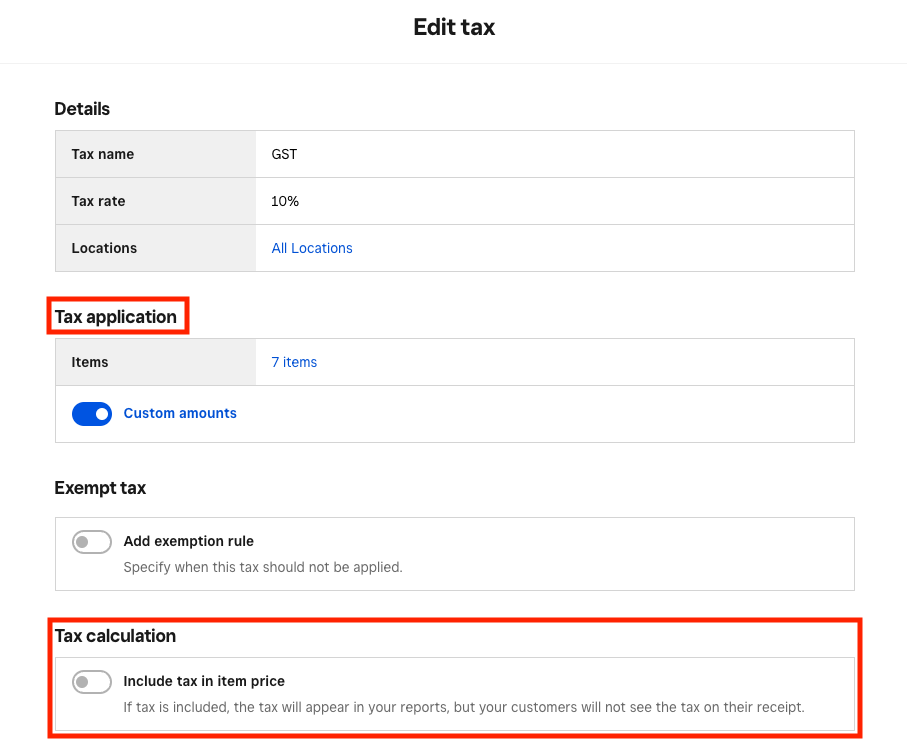

I've included a screenshot below of where to find these settings from your online Square Dashboard. From your Square Dashboard, navigate to Account & Settings > Business Information > Sales Taxes > and select the applicable tax.

It's important to note that by including the sales tax in your item price, this will not display the tax on customer receipts and will not impact the transaction total. When setting to exclude from item price, tax is then added on top of the transaction total and customers will see the tax displayed on their invoices and receipts.

I hope this helps to clarify these settings. Let me know how you go on your end!

Community Moderator, Australia, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

This reply was created from merging an existing thread: How to charge GST on service charge

Singapore

GST (7%) Only: Price x 1.07

Service Charge (10%) Only: Price x 1.10

Supposed to be

GST and Service Charge: Price x 1.177

For example,

Meal costs you $100

You’ll first have to add a service charge of 10% raising the total to $110.

The $110 is then taxed a GST of 7% adding another 7.70 to your total, leaving you with a bill of 117.70

But on Square

Meal costs you $100

Add a service charge of 10% raising the total to $110.

$100 is taxed a GST of 7% adding another 7.00 to your total, leaving you with a bill of 117.00

Is there any way to change system?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Welcome to the Seller Community 👋

This thread includes a lot of helpful information from @Seamus about GST that may help you, @wabisabi1!

For tax advice questions, make sure to reach out to a tax professional, since Square can’t provide tax advice.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report