- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

I will be selling at an out-of-state event in Las Vegas. Before I leave the event I will need to fill out a sales report and submit the tax to the organizer who will then forward it to the Vegas tax office.

So I've set up a "las vegas sales tax" at their rate of 8.375% in square.

So when I make a sale, I just run the card as normal, put in the sold amount (let's say $20) and do I have to select "apply tax" or something to the sale? Or will square just do that automatically unless I tell it not to?

And is there a way to generate a sales tax report at the end of the show?

Thank you in advance! I just want to be as prepared as possible 😃

😃Jen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @Jen7

What you can do here is the day prior or day of the event, you can enable the Nevada Sales Tax for all of your items so that it will be automatically applied to all of your purchases and you will then just be able to run the card at the event.

If you have a sales tax setup for your State as well, you can disable that tax (make sure that the Nevada one is enabled) and it will apply the tax. You can also add the sales tax to your items that you sell.

To do this from you Account Dashboard head to:

Accounts & Settings > Business > Sales Tax

Click on the Nevada Sales tax you Created

In the Section that says "Apply Tax" , click on the items , this should bring up a new window.

Click on the Select All in the top right corner, and then Assign Items . This will apply the tax to all the items that you will be selling

To generate a sales tax report, from the Dashboard click on Reports > Taxes and that will generate the sales tax collected for that day ( be sure t adjust/filter the dates if needed)

Happy Selling at the event.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey @Jen7

What you can do here is the day prior or day of the event, you can enable the Nevada Sales Tax for all of your items so that it will be automatically applied to all of your purchases and you will then just be able to run the card at the event.

If you have a sales tax setup for your State as well, you can disable that tax (make sure that the Nevada one is enabled) and it will apply the tax. You can also add the sales tax to your items that you sell.

To do this from you Account Dashboard head to:

Accounts & Settings > Business > Sales Tax

Click on the Nevada Sales tax you Created

In the Section that says "Apply Tax" , click on the items , this should bring up a new window.

Click on the Select All in the top right corner, and then Assign Items . This will apply the tax to all the items that you will be selling

To generate a sales tax report, from the Dashboard click on Reports > Taxes and that will generate the sales tax collected for that day ( be sure t adjust/filter the dates if needed)

Happy Selling at the event.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Thank you so much Dan! That seems very easy! Yeeeehaw! 😃

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Most welcome! Enjoy and make lots of sales!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Dan, I don't have "buttons" that say Apply Tax, Select All, or Assign Items.

We have a Vegas event coming up, and we are based in Fort Wayne, IN. I need to make sure this is all squared away (pun intended). Plus I wasn't aware we needed to fill out a form before we leave the event.

Can you help me?

I tried to upload a screen shot, but it won't allow it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Hey there @dave_shilling

Our dashboard has changed a little bit since the post by @ScoropionCoating

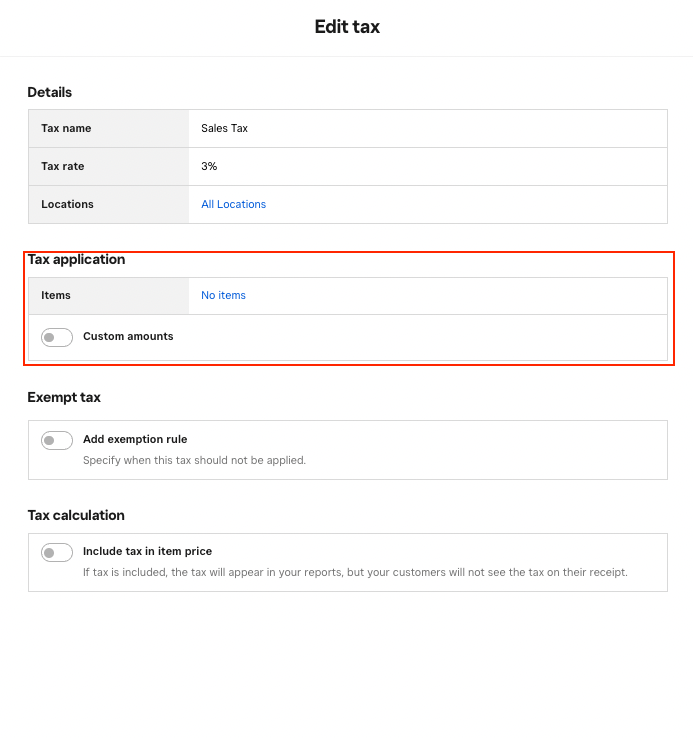

Here are some screenshots that will help to locate how this setting looks today:

To apply tax or Assign items you will have to edit the Sales Tax that you created and then click where it says No Items (this will look different if you already have items assigned) and from there put a check on every item that applies or use the Select All option that will be shown on the corner of the little pop up that appears with your item list. The Custom Amounts toggle button is used for when you process sales that aren't itemized.

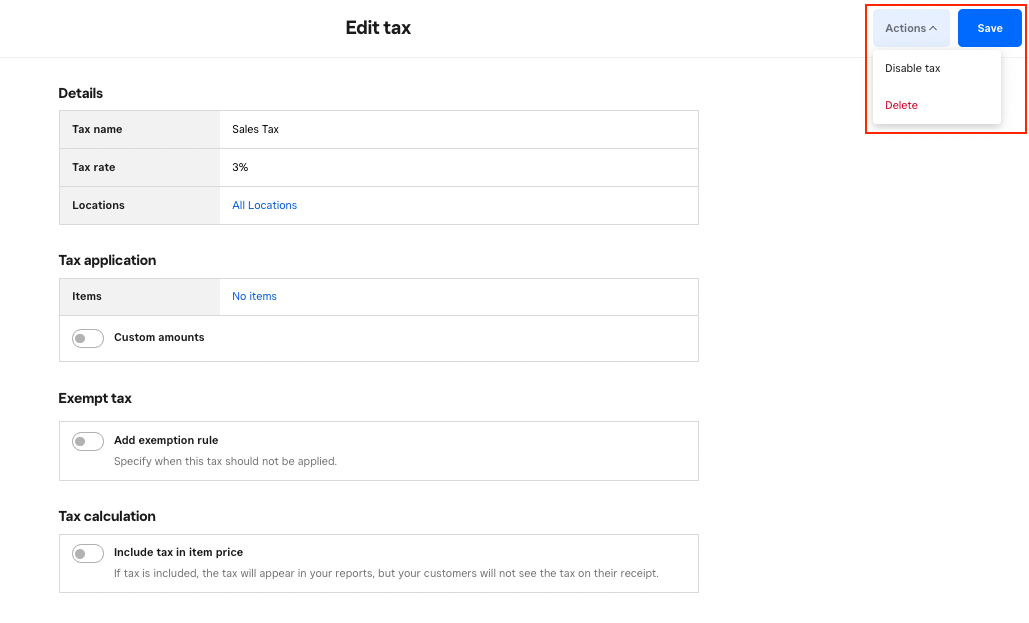

After you're done using this tax you can den disable it using the Actions Menu. Here's what that looks like:

I hope this information is helpful!

P.S. Welcome to the Seller Community

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

There is not a "no items" box listed in my tax applications.

We don't list any items in the app or website. We have literally thousands of items, and we just sell "off the table." SO, is creating a new tax box for each state we sell in going to be sufficient?

df

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

If you use the same location for all the States you Sell in then yes that will be sufficient. However, do keep in mind that you need to make sure that the taxes are set to No Items, or else all products will get all taxes applied to them at checkout. Typically the best way to approach sales in different States or Tax regions would be to create additional locations and assign a Sales Tax to each one of them.

I hope this information is helpful @dave_shilling

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report